Entrepreneur News

Report IDs 8 trends shaping future of work in a post-COVID Canada

A new report released today from the Brookfield Institute for Innovation + Entrepreneurship (BII+E) at Ryerson University explores the biggest social, political, economic, environmental and technological trends driving Canada’s labour market in the decade ahead.

Cyberfraud a growing concern for small business as pandemic forces them to digitize

The pandemic has made Canadian small businesses more vulnerable to cyberattacks, new research from the Canadian Federation of Independent Business (CFIB) reveals.

Anytime Fitness Franchises call on provinces to safely reopen gyms

Owners of independently-operated Anytime Fitness locations across Canada are sending letters to provincial leaders and health officials in Alberta, Manitoba, Ontario, and Quebec – where health clubs remain closed – inviting them to work together with the health club industry to establish province-approved safety and sanitation protocols that permit these essential businesses to reopen.

Desjardins Insurance earmarks $1 million in support of small businesses

Desjardins Insurance is supporting small businesses across the country through an innovative program called the GoodSpark Small Business Grants...

BlackNorth Initiative, We Are Womxn join forces to help Black female entrepreneurs

We Are Womxn and BlackNorth Initiative have partnered to help end what they describe as “systemic anti-Black racism in the Canadian food and beverage industry” by empowering young Black women to see themselves as successful entrepreneurs and to offer them the tools to start them on their journey.

181,000 Canadian small business owners may have to shut down: CFIB

One in six or a staggering 181,000 Canadian small business owners are seriously contemplating permanently closing, putting more than...

Webinar to explore the power of Emotional Intelligence

A Wikipedia posting describes Emotional Intelligence as the capability of individuals to recognize their own emotions and those of others, discern between different feelings and label them appropriately, use emotional information to guide thinking and behavior, and manage and/or adjust emotions to adapt to environments or achieve one’s goals.

The National Bank SME Growth Fund, L.P. up and running

With the participation of more than 245 private investors, National Bank Private Investment says it has completed the initial capitalization of $200 million for the National Bank SME Growth Fund, L.P.

Rapid COVID-19 vaccination critical for key group of essential workforce: FHCP

New resources released by Food, Health & Consumer Products of Canada (FHCP) will help employers understand evolving public health guidance on vaccination as the sector continues to work to ensure prioritized distribution of COVID-19 vaccines for food, health, and consumer goods manufacturing workers, the organization said this week.

EY’s Wong message to MOMENTUM delegates: ‘Time to return to better’

There is much work to be done for any organization when it comes to responding to the effects of COVID-19, but moving forward the focus should be squarely directed on innovation, says EY global chief innovation officer Jeff Wong.

Canadian IPO market: 2020 was a good year in spite of COVID-19

The Canadian IPO market surprised in 2020 with proceeds in excess of $5 billion for the year, despite fewer new issuances than in previous years, PWC Canada said in a release issued today.

EY releases five tax saving tips for Canadian private business owners

Canadian private business owners can reduce balance owing and increase the potential for a refund by preparing for their tax return now instead of waiting until April, according to EY Canada’s Top 5 year-end tax considerations for private companies that outlines the opportunities for savings.

OPSEU to Ontarians: Support local businesses during lockdown

Ontario Public Services Employees Union (OPSEU) president Warren (Smokey) Thomas is calling on everyone in Ontario to support local businesses during the province-wide COVID-19 lockdown that takes effect Boxing Day.

Exploring COVID-19’s impact on mental health of entrepreneurs: Marie’s story

Editor’s Note: This is the third in a three-part series based on new research from the Business Development Bank...

Repeated lockdowns will create depression, not recession: MEI

The Quebec government this week announced new stricter lockdown rules before the holidays, yet repeated lockdowns, even if partial, are likely to inflict the effects of an economic depression on SMEs rather than those of a simple recession, an economic note prepared by Peter St. Onge in collaboration with Maria Lily Shaw on behalf of the Montreal Economic Institute (MEI) warns.

Exploring COVID-19’s impact on mental health of entrepreneurs: Michael’s story

Editor’s Note: This is the second in a three-part series based on new research from the Business Development Bank...

Canada’s Main Streets and small businesses face extreme uncertainty: Study

Vancity, Vancity Community Investment Bank (VCIB), and the Canadian Urban Institute, this week released research that examines seven of Canada’s main streets, offering insight into how small businesses have been impacted by COVID-19 since April.

Exploring COVID-19’s impact on mental health of entrepreneurs: Part 1

Last month, BDC released some alarming, but certainly not surprising findings on the overall mental state of Canadian entrepreneurs many of whom are grappling with a pandemic that has caused untold harm.

Black Entrepreneurship Program receives major funding boost

The federal government this week announced a pledge valued at $221 million to the Black Entrepreneurship Program.

See It Be It campaign and new research released by WEKH

The Women Entrepreneurship Knowledge Hub (WEKH) is releasing a new research report Women Entrepreneurs Beyond the Stereotypes and awareness campaign it said is designed to “celebrate women entrepreneur success stories and crush male-dominated stereotypes of entrepreneurship.”

eBay Canada unveils its 2020 Entrepreneur of the Year Awards winners

Today, eBay Canada announced the winners of its 16th annual Entrepreneur of the Year Awards, honouring Canadian entrepreneurs using eBay’s global marketplace to build and scale their thriving businesses.

Pandemic fast-tracked digital transformation for small business: PayPal

A new report by PayPal Canada, Business of Change: PayPal Canada Small Business Study, shows how dramatically the pandemic has accelerated digital commerce for Canadian small businesses.

Many entrepreneurs wish they could bail, but aren’t prepared: KPMG

With ongoing uncertainty caused by the COVID-19 pandemic, more than a third (37%) of business owners surveyed in Canada wish they could retire, transition or sell their business but are not prepared, finds a recent poll by KPMG in Canada.

Ng visits small businesses in GTA to highlight revamped CanExport program

As Canadian small businesses continue to adapt to the new reality of COVID-19, the federal government says it is “working hard to support small business owners as they rebuild and explore new opportunities in the global marketplace.”

Thinking Capital completes buyout of Fintech platform, reaches $1 billion mark for small business funding

Thinking Capital Finance Corp., a digital lender to small businesses, has completed the acquisition of Ario, a finance-as-a-service technology platform.

Smaller firms recovery takes hit despite start of holiday shopping season

Small businesses recovery has taken a step back as COVID-19 cases increase, according to the latest results from the Canadian Federation of Independent Business (CFIB)’s #SmallBusinessEveryDay Dashboard:

Small business says trade critical to Canada’s economic recovery: FedEx

Canadian small businesses have made it clear that economic recovery and international trade are intricately linked with 80% agreeing that increasing trade between Canada and other countries will improve the economy overall.

Despite lack of support, Canada’s women entrepreneurs finding new and creative paths to growth

Women currently comprise 28% of all entrepreneurs in Canada but represent only a small percentage of high-growth firm founders.

Free contact tracing tool now available for firms who need to track customers

Canadian technology company GroundLevel Insights this week launched CANATRACE, a free digital offering that allows businesses to capture pertinent customer data needed for contact tracing, all while alleviating the workload of staff and keeping patrons – and their contact information safe.

NACO announces new initiatives to mobilize angel activity for entrepreneurs

Ottawa has announced plans to invest $710,000 in support for initiatives to be delivered by the National Angel Capital Organization (NACO) in both Western Canada and Atlantic Canada. The initiatives are designed to “support the early-stage capital ecosystem and create new pathways to scale and growth for entrepreneurs.”

BDC‘s 41st edition of SBW focuses on resilience, innovation

Business Development Canada’s Small Business Week (SBW) is going completely virtual this year with exclusive events taking place this week, highlighting the resilience and innovation of entrepreneurs in the face of today’s unprecedented challenges.

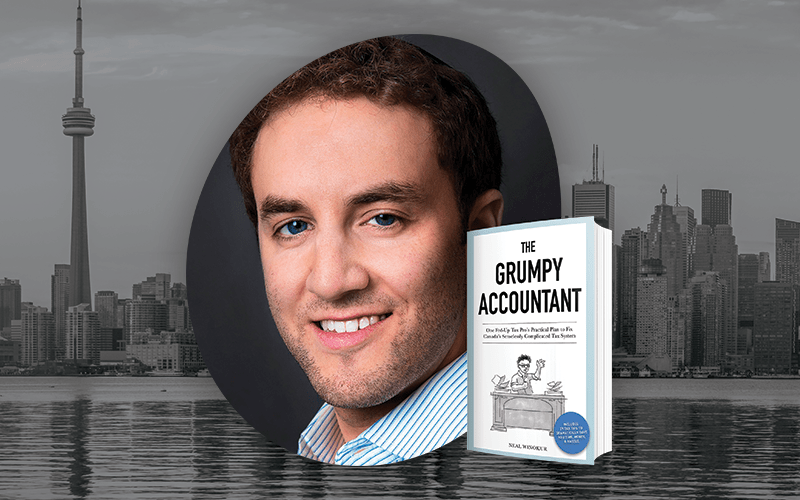

Lively sound-off about this nation’s taxation woes set for Oct. 21

Next Wednesday at 1:30 p.m. EDT, Canada’s Podcast will hold its first live discussion/podcast and if you are interested in learning about what is wrong with Canada’s tax system, this event is made for you.

Canadian entrepreneurs shifting priorities, taking advantage of new trends brought on by COVID-19: BDC

Most small and mid-sized enterprises (SMEs) are looking ahead and taking action to prepare for the future despite COVID-19, according to BDC’s study, “The Response: How Entrepreneurs Are Adapting to the Pandemic.” The study identifies five priorities for entrepreneurs as they plan for the future, as well as how the pandemic has changed Canadians’ habits.

Ontario SMBs to receive $60 million in funding through provincial PPE grant

Prabmeet Sarkaria, associate minister of small business and red tape reduction, today announced Ontario’s Main Street Recovery Plan and said the provincial government plans to introduce the Main Street Recovery Act, 2020.

CFIB exec on threat of 2nd shutdown: Government response time must improve

If there is another major shutdown because of growing COVID-19 cases all levels of government need to be more proactive when it comes to assisting small business, says an executive with the Canadian Federation of Independent Business (CFIB).

Small businesses in Alberta finding way to launch, grow and succeed: MNP

In the past several months, Calgary and the surrounding area has experienced a great deal of additional stress to the local economy, says national accounting, tax and business consulting firm MNP in a release issued today. Small, medium, and large businesses have been affected by COVID-19, the global slowdown and the ongoing challenges of the current oil-influenced economic downturn, it adds.

CFIB gives federal Speech from the Throne a thumbs-up

The Canadian Federation of Independent Business (CFIB) said it is pleased with this week’s Throne Speech, which focused government on the continued economic response to COVID-19. The impact of the first wave is far from over for small business, it added, with fewer than a third making their normal revenues.

Veuve Clicquot announces BOLD Woman Awards to honour female entrepreneurs

Veuve Clicquot says it has turned the spotlight on female business leaders with the introduction of BOLD by Veuve Clicquot, an international program dedicated to supporting female entrepreneurship.

Small business owners say resilience will help them weather COVID-19 storm

Canadian small business owners are counting on their resilience and optimism to help them weather the COVID-19 storm, according to a new RBC Small Business poll conducted by Ipsos.

CFIB says support for small business a priority in upcoming Throne Speech

Small businesses are looking for next week’s Throne Speech to signal support through the recovery period, says the Canadian Federation of Independent Business (CFIB).

Canadian start-ups recognized with Mitacs’s Entrepreneur Awards

Mitacs recently recognized five up-and-coming researchers-turned-entrepreneurs for their ground-breaking innovations that are helping to propel Canada’s economy forward — and ultimately, improve the lives of Canadians — amid the COVID-19 pandemic.

Ottawa announces support for Black entrepreneurs and business owners

The federal government this week announced investments of up to nearly $221 million in partnership with Canadian financial institutions to launch Canada’s first-ever Black Entrepreneurship Program.

Panel formed for newly launched Canadian Centre for the Purpose of the Corporation

The Canadian Centre for the Purpose of the Corporation (CCPC) has announced the members of an “expert panel” put together to help Canadian businesses and organizations “redefine and strengthen both the scope of their purpose and the contributions they make more broadly to society.”

Telfer School of Management releases Gender-Smart Entrepreneurship Education & Training Plus report

The Telfer School of Management at the University of Ottawa has launched the Global Gender-Smart Entrepreneurship Education and Training Plus (GEET+) report.

Small businesses urge Ottawa to put an end to the Port of Montreal strike

The two-week old Port of Montreal strike is having a negative impact on many small businesses that are already struggling to cope with the COVID-19 pandemic, says the Canadian Federation of Independent Business (CFIB).

BridgePoint throws lifeline to small firms impacted by massive Eglinton LRT project

In response to the more than the estimated 3,000 small businesses negatively affected by the Eglinton Crosstown LRT project, BridgePoint Financial said today it has launched CrosstownHelp, an expropriation and business-loss consulting and financing program designed to “help recoup losses and restore financial and business stability to those impacted by the delayed infrastructure project.”

Findings indicate 58% of Canadian small businesses now rehiring thanks to Stage 3 reopenings

As Canadian provinces begin entering Stage 3 of reopening, they are also embarking on another promising economic phase: rehiring. A new survey conducted by Wagepoint, creators of online small business payroll software, found that 58% of small businesses that laid off staff due to COVID-19 are now planning to rehire in the next three months.

New report reveals women entrepreneurs face structural inequalities, which are exacerbated by COVID-19

The Women Entrepreneurship Knowledge Hub (WEKH) has released The State of Women’s Entrepreneurship in Canada 2020, a report that reveals COVID-19 has amplified structural barriers, has affected women entrepreneurs more than men and has affected Indigenous, racialized and other diverse entrepreneurs most of all.

Future economic stars: MaRS announces firms in its Momentum program

MaRS, which bills itself as North America’s largest urban innovation hub, has announced the ventures that make up its current Momentum portfolio, a multi-sector program designed to support high-growth Canadian companies on their way to reaching $100 million in revenue in the next five years.

Neurotech start-up Zentrela receives $850K to build database on effects of cannabis

Canadian neurotech start-up Zentrela today announced the completion of an $850,000 seed round led by Jornic Ventures.