Some good news for Canadian homebuyers, according to a new report on housing affordability in Canada by RBC’s Assistant Chief Economist Robert Hogue.

Robert Hogue

Here’s part of the report:

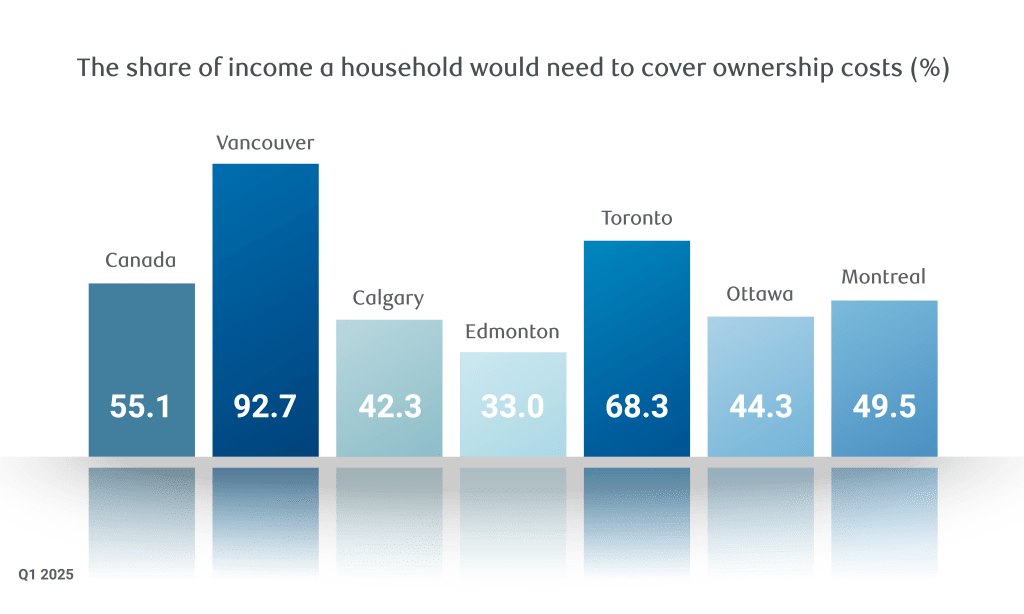

Interest rate cuts continue to drive homeownership costs lower. A slight easing in home prices and sustained household income gains also contributed to lowering RBC’s aggregate affordability measure for Canada to 55.1% in Q1 2025 from 60.7% a year earlier.

- Prices are still a long way from more attainable pre-pandemic levels. Steady improvements in the past five quarters have reversed only roughly a third of the loss of affordability nationwide. Buying conditions remain extremely challenging in many major markets.

- Ownership costs dropped in most markets. Vancouver and Toronto recorded the largest decreases in Q1, but they are still Canada’s least affordable markets. Quebec City, Montreal and Victoria saw costs rise.

- Generally improving trends are likely to be sustained. We see earlier interest rate cuts continuing to favourably impact affordability with price declines in some markets further aiding the process. Whether this will spur potential buyers into action will depend on whether de-escalation of the trade war continues to boost confidence.

Affordability stress eases more for condo buyers

The positive shift in the last five quarters has helped homebuyers’ prospects across all regions and housing market segments. However, it’s been condo buyers that have seen the most significant turnaround.

In some parts of the country—including Edmonton, Saskatoon, Regina, Winnipeg and even Toronto—the condo affordability measure is now effectively back to where it was before the pandemic. Little resetting was needed in most cases as condo affordability had not deteriorated much during the pandemic.

But Toronto’s condo measure returning so close to its pre-pandemic level is noteworthy, because it spiked from 2021 to 2023. Moderate price declines have significantly amplified the generally positive effect of lower interest rates.

Price drops also quickened the improvement in condo affordability in Vancouver and Victoria—Canada’s two other priciest markets—though both still have a lot more lost ground to recover.

Continued growth or smaller dips in prices has somewhat stalled the easing process in Calgary, Ottawa, Montreal and other markets.

The same applies to all single-detached homes segments we cover across the country. Despite material improvement, affordability remains worse than it was before the pandemic—substantially so in Vancouver and Victoria.

Most of the improvement likely behind us

On an aggregate basis, we think interest rate cuts, further price drops in some markets and sustained income gains are set to reverse approximately half the rise in RBC’s composite affordability measure for Canada during the pandemic by year end—up from about one-third most recently.

Any further progress gets trickier once interest rates stabilize, because than it rests entirely on the evolution of home prices and household income (the denominator in RBC’s affordability measures).

Price drops or strong income gains would be required to further drive significant improvement. However, we expect generally stable prices in Canada over the next two years—with some local exceptions—and modest wages growth amid persistent labour market slack.

Are affordability issues back on the front burner?

The trade war derailed Canada’s housing market recovery this spring as worries about the potential economic fallout prompted many buyers to retreat to the sidelines. Recent de-escalation of tariffs, however, could be alleviating some fears.

Early signs emerged in May that point to resale activity possibly turning a corner—yet prices remained under downward pressure in Ontario and British Columbia.

Rebuilding confidence is clearly positive for the housing market, but it is unlikely to trigger a broad-based rally. Housing affordability issues are poised to be top of mind again in many parts of the country, and a major obstacle hindering recovery.

The full report can be accessed here.

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Entrepreneur. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 and 2024 as one of the top business journalists in the world by PR News. He was also named by RETHINK to its global list of Top Retail Experts 2024 and 2025.

About Us

Canada’s Entrepreneur is the number one community media platform in Canada for entrepreneurs and business owners. Established in 2016, our podcast team has interviewed over 800 Canadian entrepreneurs from coast-to-coast. With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 250,000 + audio downloads, 50,000 + average monthly social impressions, 15,000 + engaged social followers and 120,000 newsletter subscribers. Canada’s Entrepreneur is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story