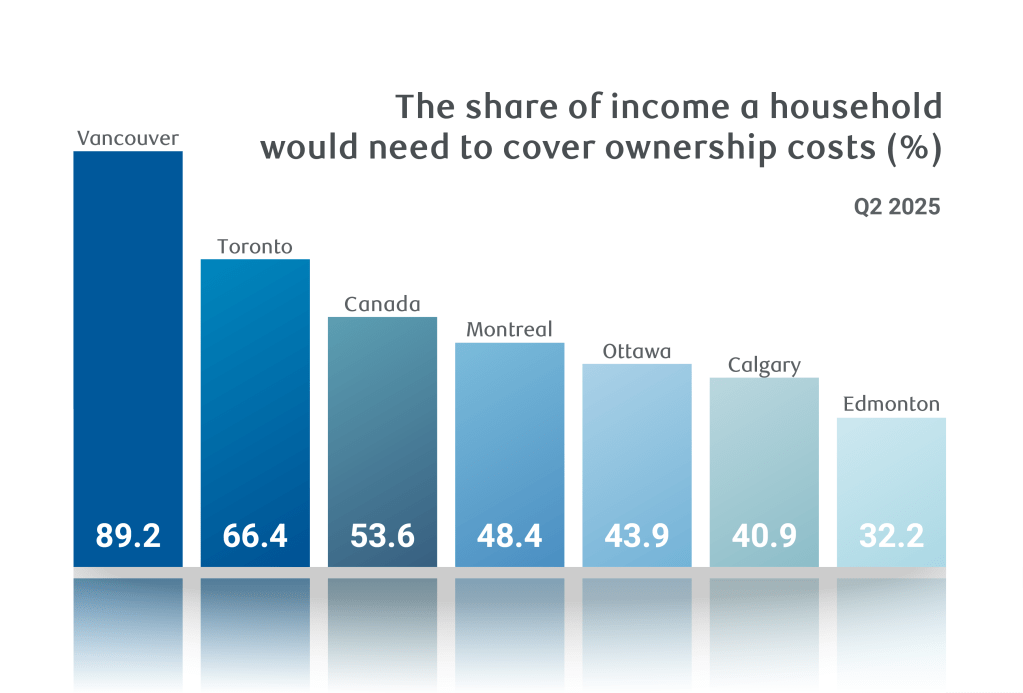

Housing affordability has improved for six consecutive quarters in Canada. Lower interest rates, flat prices and sustained household income gains contributed to lowering RBC’s aggregate affordability measure for Canada to 53.6% in Q2 2025 from an all-time high of 63.5% at the end of 2023, according to a recent report.

The RBC report said ownership costs fell in all but one market. Vancouver, Toronto and Victoria recorded the largest decreases, but they remain Canada’s least affordable markets. Regina saw costs rise slightly.

Capacity to own is facing headwinds

“Increasing slack in the labour market is now weighing on wage growth, creating fresh challenges for prospective homebuyers. This shift threatens to negatively impact buyers’ purchasing power just as housing markets show signs of stabilization across several regions. Robust household income growth has contributed to more than a third of the decline in RBC’s national aggregate affordability measure over the past year and a half. (A decline in the measure represents a gain in affordability),” said RBC.

“This income component has been crucial in offsetting elevated borrowing costs and stubborn prices in many markets. However, the tailwind is beginning to weaken as employment conditions deteriorate. Ontario markets could be especially affected by this emerging trend. The unemployment rate in the province has risen significantly above pre-pandemic levels, and is now among the highest in the country. The ongoing trade war is taking a toll on the province’s manufacturing sector with ripple effects spreading through related industries and supporting services.”

Bulk of affordability gains now in rearview mirror

“We anticipate interest rate reductions, more price corrections in select markets, and continuing (albeit slowing) income growth will offset roughly half of the pandemic-era increase in RBC’s composite affordability measure for Canada by year-end. About one third has been achieved so far,” added RBC.

“Further advancement becomes more challenging once interest rates reach a stable plateau as it depends exclusively on home price movements and household income trends. Substantial price declines or robust increasing income would be necessary to drive more meaningful gains. However, we anticipate broadly stable pricing across Canada over the next two years with some regional variations and moderate wage increases.”

Housing costs resurface as central concern

Trade tensions disrupted Canada’s housing market momentum this spring as concerns over potential economic consequences led many prospective buyers to the sidelines. However, the easing of tariff pressures since spring has helped restore some market confidence, explained RBC.

“Home resales have shown signs of recovery through the summer months—though property values continued to face downward pressure across Ontario and British Columbia. This price softening supports affordability improvements, but simultaneously signals persistent market fragility and cautious buyer sentiment,” added the report.

“Growing confidence represents a constructive development for housing markets, but it’s insufficient to spark a widespread activity rebound. Housing cost burdens are set to become the primary concern in part of the nation despite improving notably since the end of 2023—representing a significant barrier to market revival. Markets where affordability has returned to historical norms, however, are on a more solid track.”

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Entrepreneur. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 and 2024 as one of the top business journalists in the world by PR News. He was also named by RETHINK to its global list of Top Retail Experts 2024 and 2025.

About Us

Canada’s Entrepreneur is the number one community media platform in Canada for entrepreneurs and business owners. Established in 2016, our podcast team has interviewed over 800 Canadian entrepreneurs from coast-to-coast. With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 250,000 + audio downloads, 50,000 + average monthly social impressions, 15,000 + engaged social followers and 120,000 newsletter subscribers. Canada’s Entrepreneur is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story